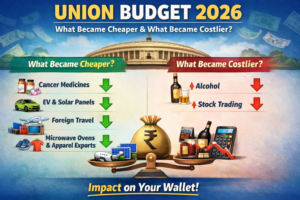

What Became Cheaper in Union Budget 2026?

1. Cancer Medicines Are Now More Affordable

The government has removed basic customs duty on 17 life-saving cancer medicines. Moreover, it has eliminated import duty on medicines and special food used to treat seven rare diseases.

As a result, treatment costs may decline, and families dependent on expensive imported drugs may experience meaningful financial relief.

2. Microwave Ovens May Cost Less

To boost domestic electronics manufacturing, the government reduced customs duty on key microwave oven components.

Because of this, production costs may fall, and companies may lower retail prices in the coming months.

3. EV Batteries and Solar Panels Become Cheaper

The budget extends tax exemptions to machinery and raw materials used in lithium-ion battery and energy storage manufacturing. In addition, the government removed duty on sodium antimonate, a key input for solar glass.

Consequently, electric vehicles and solar panels may become more affordable, encouraging clean energy adoption.

4. Shoes, Clothes, and Seafood May See Price Relief

To strengthen exports, the government announced duty concessions on raw materials used in the leather, textile, and seafood sectors.

If manufacturers pass on the benefit, consumers may see lower prices or at least stable rates for footwear, garments, and seafood products.

5. Foreign Travel Gets Cheaper

The government reduced Tax Collected at Source (TCS) on overseas tour packages to a flat 2%, removing earlier spending limits.

Therefore, travelers will face lower upfront costs and less cash blockage.

6. Aircraft Maintenance Costs Decline

The budget removes customs duty on aircraft parts and components used for maintenance and repair.

Over time, this move may reduce operating costs for airlines and help keep airfares in check.

7. Personal Imports Become More Affordable

The government cut tax on imported goods meant for personal use from 20% to 10%.

As a result, individuals importing items from abroad will pay less overall.

What Became More Expensive after Union Budget 2026?

1. Alcohol Prices May Rise

The government increased TCS on alcohol from 1% to 2%.

Because sellers often transfer higher costs to consumers, retail prices may increase.

2. Stock Market Trading Turns Costlier

The budget raises Securities Transaction Tax on futures and options trades.

Due to this change, frequent and short-term traders will face higher transaction costs.

Key Budget Clarifications You Should Know

Many people expect prices to fall immediately after tax cuts. However, tax changes usually apply only to new stock. Retailers continue selling older inventory at existing prices.

Additionally, companies decide whether to pass on cost savings, so price reductions are never guaranteed.

Similarly, the budget does not control GST rates. Instead, the GST Council determines GST slabs through separate meetings.

The Bigger Economic Picture

India’s economy continues to grow at a strong pace. Therefore, the government has chosen stability over big-ticket announcements. It has increased capital expenditure and focused on infrastructure, manufacturing, semiconductors, and rare earth minerals.

As a result, the budget supports job creation and long-term economic resilience rather than short-term relief.

Conclusion

Union Budget 2026 prioritizes steady growth and structural reform. On one hand, healthcare, clean energy, aviation, and travel-related costs may decline. On the other hand, alcohol and stock market trading may become more expensive. Overall, the budget aims to strengthen the economy gradually while easing costs in critical sectors that affect everyday life.

Read more: Supreme Court Stays New UGC Rules, Asks Centre to Redraft Amid Nationwide Opposition